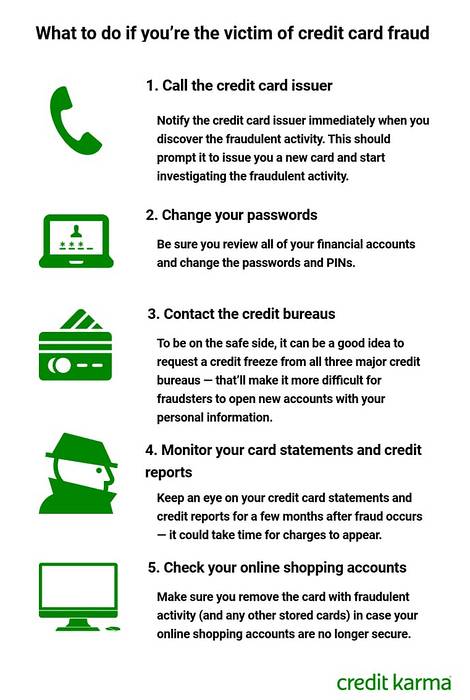

- 5 steps to take if you're a victim of credit card fraud. ...

- Call your credit card company immediately. ...

- Check your credit card accounts and change your passwords. ...

- Notify the credit bureaus and call the police if necessary. ...

- Monitor your statements and credit reports. ...

- Check your online shopping accounts. ...

- Bottom line.

- How serious is credit card fraud?

- Can I press charges for credit card fraud?

- Do police investigate credit card fraud?

- How long do you go to jail for credit card fraud?

- Who pays when a credit card is used fraudulently?

- Can they track who used my credit card?

- Can you report credit card fraud to the police?

How serious is credit card fraud?

The penalties for credit card fraud in California can vary depending on the circumstances and severity of the case. On the low end, it is a year in county jail and a $1,000 fine. On the high end, it is punishable by up to three years in county jail and a $10,000 fine. Credit card fraud is also a federal offense.

Can I press charges for credit card fraud?

Credit card fraud and identity theft are serious crimes. The victim does not know a crime has been committed until sudden charges are made to the credit card. ... Pressing charges for a credit card fraud is an important step toward regaining the money charged by the criminal and regaining a good credit score.

Do police investigate credit card fraud?

For the most part, they DO NOT investigate credit card fraud due to its International nature. The State Police will investigate “stolen” credit cards when they have a suspect(s) found during their initial investigation. ... The best thing you can do is to report it, with all due speed, to the Credit Card Company.

How long do you go to jail for credit card fraud?

Credit card fraud that involves the theft of the card or the number typically has a prison sentence of 1 to 5 years. Identity theft is treated much more harshly with prison sentences up to 10 or 20 years.

Who pays when a credit card is used fraudulently?

“The bank is more likely to be liable for the fraud for card-present transactions, while the merchant might get stuck with the cost for transactions without a physical card.” The rules on liability are dictated by the credit card network the transaction used, such as Visa, Mastercard, American Express or Discover.

Can they track who used my credit card?

Credit card companies can track where your stolen credit card was last used, in most cases, only once the card is used by the person who took it. The credit card authorization process helps bank's track this. However, by the time law enforcement arrives, the person may be long gone.

Can you report credit card fraud to the police?

Many wonder whether it is prudent to file a report directly with the police in the event of credit card fraud. Since this is a crime, yes, the victim of the credit card fraud should promptly inform the police. In fact, the Canada Anti-Fraud Centre recommends that you file a police report.

Naneedigital

Naneedigital