Tech Tools to Calculate the Cost of Living on Your Own

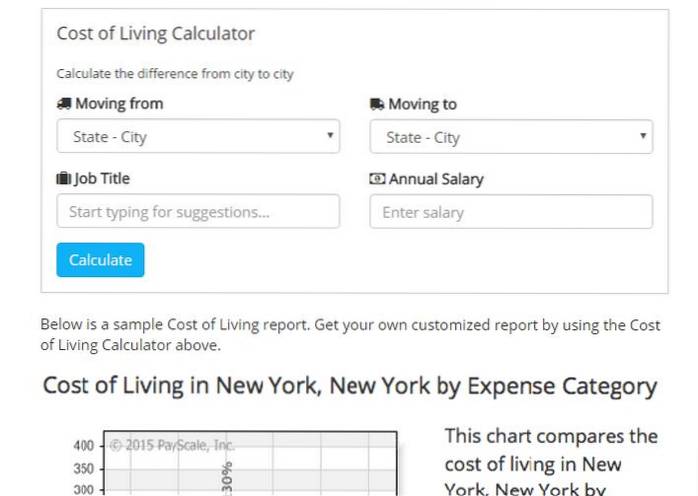

- Cost of living calculator. ...

- Utility cost calculator. ...

- Insurance calculation tools. ...

- “Should you cut the cord?” Tool. ...

- Gas Buddy. ...

- Numbeo food cost calculator. ...

- Level Money App.

- What are the costs of living on your own?

- Where can I find cost of living data?

- How do I live on my own budget?

- How much does it cost to live on your own per month UK?

- What bills do most adults pay monthly?

- How much does a single person need to make to live comfortably?

- What is the standard cost of living raise for 2020?

- What are living expenses?

- Where is the lowest cost of living?

- Is $5000 enough to move out?

- How much does an average person spend on food per month?

- How much should I budget to move out?

What are the costs of living on your own?

Rent (includes heat, water, sewer, and parking): $800, plus an $800 security deposit at move-in. Electricity: I'll likely pay around $50 a month. Netflix + Hulu Subscriptions: $18 a month. Food: I shop weekly and spend around $40, so that's about $160-$180 a month.

Where can I find cost of living data?

Salaries, Costs of Living, & Relocation

- Bankrate.COM - www.bankrate.com. ...

- Chamber of Commerce Directory - www.chamberofcommerce.com.

- CityRating.com - www.cityrating.com. ...

- CNN Money - http://money.cnn.com/best/bpretire. ...

- Cost of Living and Salary Comparison Wizard, Salary.com - http://swz.salary.com/CostOfLivingWizard/LayoutScripts/Coll_Start.aspx.

How do I live on my own budget?

Ways to lower your cost of living include:

- Reduce Your Rent: You might end up paying less each month by moving into a two-bedroom apartment with a roommate instead of living on your own in a studio or one-bedroom.

- Lower Your Non-Essential Spending: Non-essential spending should be among the first to go.

How much does it cost to live on your own per month UK?

According to data comparison website Expatistan, the average UK cost of living is: £2,249 per month for a single person; and. £3,803 per month for a family of four.

What bills do most adults pay monthly?

Necessities often include the following:

- Mortgage/rent.

- Homeowners or renters insurance.

- Property tax (if not already included in the mortgage payment).

- Auto insurance.

- Health insurance.

- Out-of-pocket medical costs.

- Life insurance.

- Electricity and natural gas.

How much does a single person need to make to live comfortably?

The median necessary living wage across the entire US is $67,690. The state with the lowest annual living wage is Mississippi, with $58,321. The state with the highest living wage is Hawaii, with $136,437.

What is the standard cost of living raise for 2020?

The Social Security Administration on Thursday announced a 1.6% cost-of-living adjustment for 2020, meaning the average retiree will get $24 more each month, or about $1,503. In 2019, the COLA was 2.8%, an increase of about $40 a month for retirees.

What are living expenses?

Basic living expenses, as the name implies, are ones necessary for daily living. Basic living expenses, as the name implies, are ones necessary for daily living, with main categories including housing, food, clothing, transportation, healthcare, and relevant miscellaneous costs.

Where is the lowest cost of living?

Here are the 10 most affordable states in the U.S.:

- Missouri. ...

- Tennessee. ...

- Georgia. ...

- Arkansas. Average cost of living index: 89.16. ...

- Alabama. Average cost of living index: 88.80. ...

- Oklahoma. Average cost of living index: 88.09. ...

- Kansas. Average cost of living index: 86.67. ...

- Mississippi. Average cost of living index: 84.10.

Is $5000 enough to move out?

Ideally, you want to save as much as possible before moving out. At the very least, you'll want three months rent and expenses, while a more reasonable safety net is six months. Depending on where you live, that three-month safety net could be anywhere from $3,200 to over $5,000.

How much does an average person spend on food per month?

That's roughly $2,641 annually per person (based on the average 2.5 people in each household). The average cost of food per month for the typical American household is about $550.

How much should I budget to move out?

Start small, with $1,000 to $2,000 in your emergency fund. You should eventually save an amount equivalent to three to six months of living expenses before moving out so you can handle unanticipated expenses, such as medical bills, insurance deductibles, and vacations.

Naneedigital

Naneedigital