- How do I freeze my credit on all three bureaus?

- How do I put a freeze on my credit?

- How do I freeze my credit for free?

- Is freezing your credit a good idea?

- Is it better to lock or freeze credit?

- How long does it take to unfreeze credit?

- What are the 3 major credit report agencies?

- How accurate is Credit Karma?

- Is LifeLock worth having?

- Can I open a bank account if my credit is frozen?

- Can I still use my credit cards if I freeze my credit?

- Can I freeze my credit card to pay it off?

How do I freeze my credit on all three bureaus?

If you want to freeze your credit, you need to do it at each of the three major credit bureaus: Equifax (1-800-349-9960), TransUnion (1-888-909-8872) and Experian (1-888-397-3742). If you request a freeze, be sure to store the passwords you'll need to thaw your credit in a safe place.

How do I put a freeze on my credit?

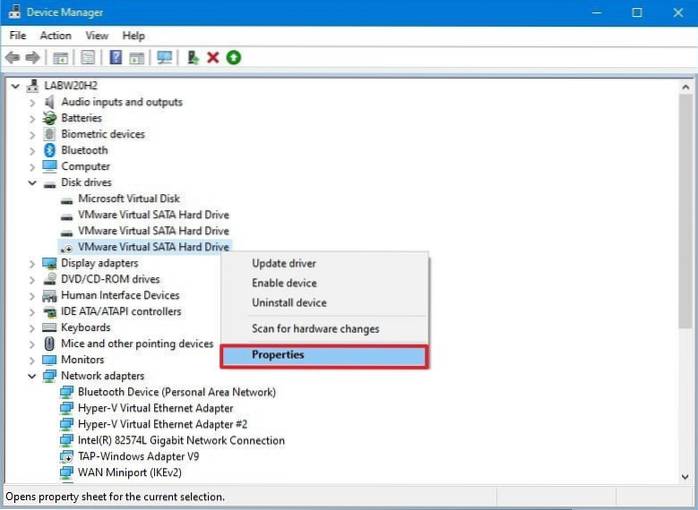

Contact each of the three major credit bureaus — Equifax, Experian and TransUnion — individually to freeze your credit:

- Equifax: Call 800-349-9960 or go online. Check out our step-by-step Equifax credit freeze guide.

- Experian: Call 888‑397‑3742 or go online. ...

- TransUnion: Call 888-909-8872 or go online.

How do I freeze my credit for free?

You must contact each national credit bureaus individually to freeze (or unfreeze) your credit reports. They'll do so for free upon request.

Is freezing your credit a good idea?

It's a great weapon against identity thieves.

A credit freeze is a great choice to help protect yourself from identity thieves because it is guaranteed by law. A credit lock also restricts access to your credit report but isn't regulated and may require a fee.

Is it better to lock or freeze credit?

Unlike a freeze, locks are not governed by federal law. Service agreements for each bureau make it clear that the companies don't guarantee error-free operation or uninterrupted service. As with a credit freeze, a credit lock is most effective if you sign up at all three bureaus.

How long does it take to unfreeze credit?

As long as your information checks out with the credit bureau, the company is required to lift the freeze within an hour if the request is made by phone or online. The bureau has to lift the freeze within three business days after getting a request by mail.

What are the 3 major credit report agencies?

On AnnualCreditReport.com you are entitled to a free annual credit report from each of the three credit reporting agencies. These agencies include Equifax, Experian, and TransUnion.

How accurate is Credit Karma?

Your Credit Karma Score May Be Insufficient

Although VantageScore's system is accurate, it's not the industry standard. Credit Karma works fine for the average consumer, but the companies that will approve or deny your application are more likely to look at your FICO score.

Is LifeLock worth having?

If you were inclined to pay $25/month for basic credit monitoring from a company like Experian, for example, then I'd say yes. Companies such as LifeLock offer many additional features for about the same price. But if you have a cheaper credit monitoring option, it may not be worth the extra spend.

Can I open a bank account if my credit is frozen?

If you froze your credit reports at all three bureaus, you would need to temporarily remove all of them before opening an account. Another question you should ask is whether your bank uses a soft or hard pull to check your credit. A soft pull won't affect your credit score.

Can I still use my credit cards if I freeze my credit?

A Credit Freeze Doesn't Affect Your Current Accounts, Like Your Credit Card Accounts. A common misconception is that a credit freeze means you can't use your current forms of credit, like a credit card. ... So, freezing your credit file doesn't affect your ability to use your existing accounts.

Can I freeze my credit card to pay it off?

If you want to temporarily stop the use of your credit card without reporting it as lost or stolen, you now may be able to do so by simply going to the issuer's website or app. Many credit card issuers now allow you to freeze and unfreeze your card to prevent purchases on your account.

Naneedigital

Naneedigital