5 of the Best Android Investment Apps You Need to Check Out

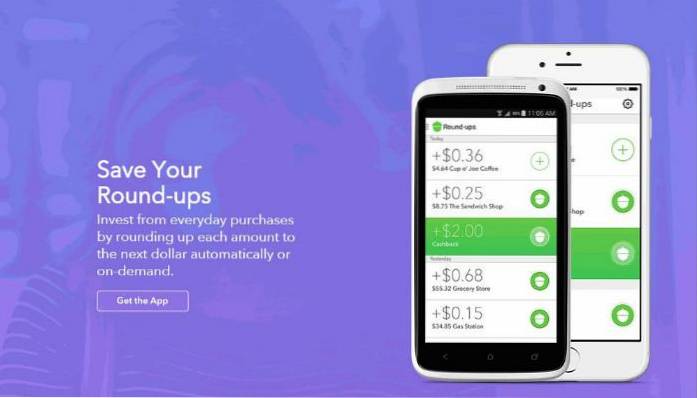

- Acorns. Want to invest in stocks but don't want to invest time learning the nuances of the stock market? ...

- Stock Trainer. Want to test the waters of the stock market without the risk of losing any real money? ...

- Robinhood. ...

- FRED Economic Data. ...

- StockTwits.

- What is the best investment app for Android?

- Which investment app is the best?

- Which investing app is best for beginners?

- What apps do investors use?

- Why is Robinhood bad?

- Is stash or acorns better?

- Which is better Robinhood or stash?

- What should I invest in right now as a beginner?

- How do beginners invest?

- What is the best free trading app?

- Is Robinhood app good for beginners?

- Where should I invest money now?

What is the best investment app for Android?

Compare Providers

| App | Why We Picked It |

|---|---|

| Acorns | Best for Beginners |

| Webull | Best for Free Investing |

| Betterment | Best for Automated Investing |

| SoFi | Best Easy-to-Use App |

Which investment app is the best?

- The best investment apps right now.

- E*TRADE.

- SoFi.

- Fidelity Go.

- Robinhood.

- Acorns.

- Ellevest.

- Charles Schwab.

Which investing app is best for beginners?

The 6 Best Investing Apps for Beginners

- Acorns: Beginner automated investing. ...

- M1 Finance: Flexibility without fees. ...

- Robinhood: No minimum simplicity. ...

- Stash: Education for beginners. ...

- Betterment: Goal-based investment. ...

- Ellevest: Investing for women.

What apps do investors use?

There are a lot of great investment apps on the market; here are some worth checking out to stay on top.

- MarketWatch. ...

- Forbes Intelligent Investing. ...

- Bloomberg. ...

- SigFig. ...

- AnalystRT. ...

- StockTouch. ...

- E*TRADE. ...

- Motif.

Why is Robinhood bad?

Robinhood provides a bare-bones trading experience, making it a poor choice for investors seeking the best trading platform. Also, Robinhood's stock research tools are severely lacking when compared to $0 brokers such as TD Ameritrade, Charles Schwab, and Fidelity.

Is stash or acorns better?

Acorns and Stash are investment apps aimed at beginners who want their money to grow but may not have the time or the expertise to manage it. ... In general, Stash is most likely to appeal to DIY, hands-on investors, while Acorns tends to be a better fit for investors who want to outsource management of their investments.

Which is better Robinhood or stash?

That depends on your goals and fee tolerance. If you can do it yourself, Robinhood is great. If you can't and want to pay someone for help, Stash and Acorns are both excellent products. But be aware that the cost comes out of your investment gains, and $1 per month in fees is a cost that adds up over time.

What should I invest in right now as a beginner?

Here are the 15 best stocks for beginners to buy:

- Amazon (NASDAQ: AMZN)

- Alphabet (NASDAQ: GOOG)

- Apple (NASDAQ: AAPL)

- Costco (NASDAQ: COST)

- Disney (NYSE: DIS)

- Facebook (NASDAQ: FB)

- Mastercard (NYSE: MA)

- Microsoft (NASDAQ: MSFT)

How do beginners invest?

6 ideal investments for beginners

- 401(k) or employer retirement plan.

- A robo-advisor.

- Target-date mutual fund.

- Index funds.

- Exchange-traded funds (ETFs)

- Investment apps.

What is the best free trading app?

The best free stock trading app is TD Ameritrade. Unlike most brokers, TD Ameritrade offers two apps: TD Ameritrade Mobile and thinkorswim Mobile. TD Ameritrade Mobile is designed for casual investors. Meanwhile, thinkorswim Mobile is designed for the feature-hungry active trader.

Is Robinhood app good for beginners?

With free trades and no account minimums, Robinhood is easy to suggest as the best brokerage for novice investors – as long as these investors are willing to find educational resources and research tools elsewhere.

Where should I invest money now?

- High-yield savings accounts. Online savings accounts and cash management accounts provide higher rates of return than you'll get in a traditional bank savings or checking account. ...

- Certificates of deposit. ...

- Money market funds. ...

- Government bonds. ...

- Corporate bonds. ...

- Mutual funds. ...

- Index funds. ...

- Exchange-traded funds.

Naneedigital

Naneedigital