- What is the best app for finance tracking?

- What online apps can you use to keep track of your transactions?

- Is Truebill better than Mint?

- What is the easiest budget app?

- Is there an app that keeps track of your spending?

- What is the easiest way to track spending?

- What is the best free app for tracking expenses?

- How trustworthy is Truebill?

- Is there anything better than Mint?

- Can you trust mint?

- Are budgeting apps worth it?

- Is it safe to link bank account to budget app?

- Can I use mint without connecting to bank?

What is the best app for finance tracking?

Best Expense Tracker Apps

- Best for Investors: Personal Capital.

- Best for Small Businesses: QuickBooks.

- Best for Mobile: Clarity Money.

- Best for Millennials: Wally.

- Most Popular: Mint.

- Best for Budgeting: YNAB.

- Best for Digital Money Envelopes: Mvelopes.

What online apps can you use to keep track of your transactions?

It's easy to set and track financial goals. You should never miss a bill payment.

...

The 10 Best Money Apps

- Acorns App. Visit Site. ...

- Mint App. Visit Site. ...

- Credit Karma App. Visit Site. ...

- You Need A Budget. Visit Site. ...

- Joy. ...

- Qapital App. ...

- Digit App. ...

- GoodBudget App.

Is Truebill better than Mint?

Truebill isn't necessarily better than Mint, and Mint isn't necessarily better than Truebill. Both Truebill and Mint provide helpful financial services if you want to create budgets or save up money for specific goals. You could also use either app to check your credit score and the factors affecting your credit.

What is the easiest budget app?

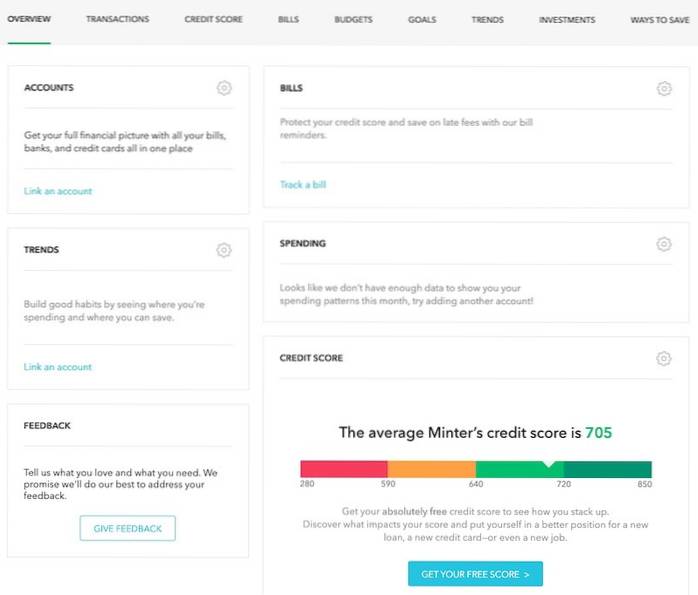

Best Free Budget App: Mint

When you download the Mint app for Apple or Android devices, you can sync up your bank accounts to automatically record budgeting expenses and income. You can use Mint to: Easily categorize expenses. Generate real-time reports on spending.

Is there an app that keeps track of your spending?

EveryDollar is a budget app that helps you track your spending and plan for purchases. It's tailored for zero-based budgeting, which is a method where your expenses equal your income. With the free version of the app, you manually enter a transaction each time you spend money to account for it in your budget.

What is the easiest way to track spending?

5 Steps for Tracking Your Monthly Expenses

- Check your account statements. Pinpoint your money habits by taking inventory of all of your accounts, including your checking account and all credit cards you have. ...

- Categorize your expenses. Start grouping your expenses. ...

- Use a budgeting or expense-tracking app. ...

- Explore other expense trackers. ...

- Identify room for change.

What is the best free app for tracking expenses?

We researched dozens of popular money-tracking apps to bring you our top picks for 2020.

- Personal capital. This is a full-featured investment manager for hire. ...

- Expensify. Available on Android and iOS devices, Expensify is great for making expense reports on the go. ...

- Concur. ...

- Wally. ...

- QuickBooks Self-Employed.

How trustworthy is Truebill?

Is Truebill Safe to Use? Any time a financial app asks for access to personal online financial records, you're right to be skeptical. ... Truebill uses the Plaid service to connect with financial institutions. Because of Plaid, you should not be asked to give banking credentials to Truebill.

Is there anything better than Mint?

#1 Personal Capital

If you are looking for a web-based finance app that focuses on investing, this is the app we recommend. ... Like Mint, Personal Capital is free to use. Unlike Mint, which focuses a lot on budgeting and where your money has gone, Personal Capital emphasizes investing and saving for retirement.

Can you trust mint?

If you need an easy-to-use tool for tracking your spending and keeping tabs on your budget, Mint.com is an excellent choice (among many other finance app alternatives). ... Quick answer: Mint uses bank-level encryption and monitoring through various 3rd parties companies for read-only access to your financial accounts.

Are budgeting apps worth it?

According to experts, it might not be much. Having an app to create a budget and track purchases seems like a good idea, but experts say simply downloading and having constant access to an app won't necessarily result in better money management or increased savings.

Is it safe to link bank account to budget app?

Be careful using a budgeting app on public Wi-Fi — You should never check your bank account or use a budgeting app over unsecured public Wi-Fi — it's just too easy for hackers to see everything you're doing.

Can I use mint without connecting to bank?

You could use the Mint app manually without connecting with any banks or other accounts. It will be a little bit cumbersome as the app is obviously designed to work through integrating with online accounts. A couple of straight-forward work-arounds should get you what you are trying to achieve.

Naneedigital

Naneedigital